20+ Investment Options

An Ameriflex HSA provides participants more options to maximize their financial savings and growth. Participants can choose to invest a portion of their HSA funds in a variety of 20+ mutual funds.

No Hidden Fees

We don’t believe participants should have to pay extra fees to reach their full savings potential. By eliminating hidden fees, participants keep more of their hard-earned money for current and future health needs.

$500 Investment Threshold

While many HSA administrators require a $2,000+ account balance before funds can be invested, Ameriflex has a modest $500 investment balance requirement, allowing participants to invest their money faster.

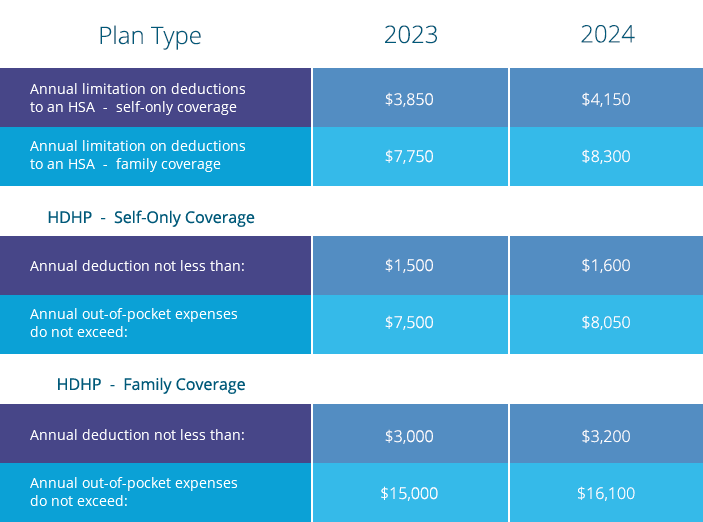

The annual HSA contribution limits are subject to inflation each year. Catch-up contributions can be made by individuals 55 or older in addition to the annual contribution limit.