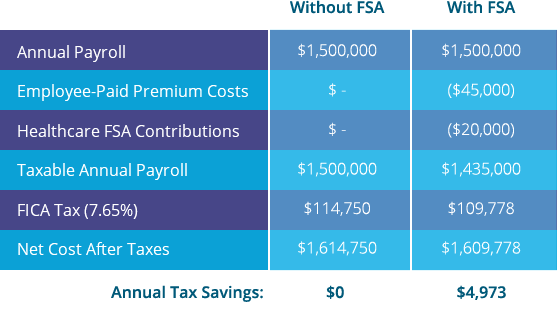

This scenario assumes the following:

- Number of Eligible Employees: 50

- Average Salary Per Employee: $50,000/year

- Average Premium Paid Per Employee: $900/year

- Average FSA Contribution: $2,000/year

- Percent Expected to Enroll in FSA: 20%

FSA Guarantee

If employees spend more than they contribute, resulting in a net aggregate loss in the employer’s plan, Ameriflex will refund the difference back to the employer.

Card Swipe Guarantee

One-of-a-kind in the industry, the Card Swipe Guarantee is a feature offered to all FSA and HRA customers where we will take on the compliance liability around documentation. Our advanced technology allows us to ensure that participants’ FSA and HRA-eligible card transactions will go through without requiring them to submit further documentation.

MyPlanConnect

MyPlanConnect connects an employee’s FSA transactions with their insurance Explanation of Benefits (EOB). If the card transaction matches the employee’s EOB, MyPlanConnect will prepare the claim and allow the employee to request reimbursement without the need to submit additional documentation.